Back to News

Back to News

Why Private Credit?

Oct 04, 2022Stellus Capital – Why Private Credit

Bethesda, MD & Houston, TX – October 4, 2022 – Registered Investment Advisers (RIAs) are continuing to appreciate the role that private credit can play in a diversified portfolio, particularly during uncertain economic times. As private lenders displace regulated banks as the main source of credit to middle market companies, private credit has outpaced the growth of private equity and venture capital over the last decade. The asset class has an estimated $1.21 trillion of assets under management (AUM) according to Preqin’s 2022 Global Private Debt Report. The Preqin report also projects that private credit will more than double in AUM by 2026 and become the third largest alternative asset category, trailing only private equity and venture capital.

The growth of private credit can be traced back to several factors. Perhaps the biggest catalyst was the aforementioned shift in the lending market, when, after the Great Recession, private credit managers assumed the role historically filled by banks. Resulting Dodd-Frank regulations hastened the rise of private credit by making it exceedingly expensive for banks to hold levered, illiquid loans. As the asset class evolves, managers have raised ever-larger pools of capital, not only grabbing market share from regulated banks, but from the broadly syndicated loan and high yield markets as well.

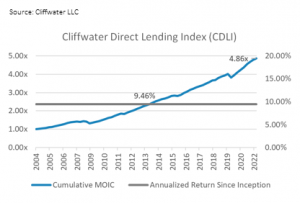

Managers have been able to raise capital to supplant these traditional capital providers as private credit performance over time has been consistent, marked by stable returns and low volatility. According to the Cliffwater Direct Lending Index (CDLI), primarily comprised of U.S. middle market corporate loans, the cumulative return of the index since inception (September 2004) is 4.86x, with an average annualized return of 9.46%. Importantly, returns in private credit have been stable over that 17-year period, with only muted temporary declines across the Great Recession and, more recently, the onset of the COVID-19 pandemic.

Today, private credit’s historical stability represents a refuge for investors as new macroeconomic and geopolitical risks surface. These new threats include inflation, at a 40-year high; recession risk, as rising interest rates are utilized to combat escalating prices; and destabilization due to the military conflict in Europe and increased tensions in Asia. It’s against this backdrop that a growing segment of RIAs are incorporating private credit into their clients’ portfolios, to provide stable income and capital preservation with low volatility.

Segmenting Private Credit

To be sure, sophisticated RIAs understand the role private credit plays in a diversified portfolio. Given the growth of the asset class, however, it’s important to clarify that the market is not a monolith. Most RIAs are familiar with the largest private credit managers who were early movers in the channel due to their scale and reach. As RIAs and their clients become more knowledgeable about the asset class, many are looking to increase their diversification by allocating to multiple segments within the category. These segments include but are not limited to:

- Corporate lending, ranging from lower/traditional middle market to upper middle market companies;

- Enterprise value/cash flow lending;

- Asset-based lending;

- Sector-focused strategies such as real estate and infrastructure;

- Niche strategies targeting royalties, consumer finance, or litigation financing; and

- Venture debt or distressed/special situation strategies.

To further contextualize the differences across the various segments, it helps to look more closely at some of the distinguishing features characterizing the largest segment of private credit – middle market corporate lending. Generally, the lower/traditional middle market corporate arena encapsulates direct lenders working with companies with EBITDA up to $50mm, while the upper middle market begins around $50mm of EBITDA and can go as high as $500mm.

Middle market private credit providers have rapidly replaced regional banks as the main source of term lending to private companies in the U.S. This shift has accelerated over time as banking regulations have continued to make leveraged lending to private, less–liquid companies uneconomical for banks. In the lower middle market these loans typically adhere to traditional bank–loan underwriting and documentation standards, complete with full financial covenant packages and robust positive and negative operating covenants. These loans can be made to either private equity-backed companies (sponsored deals) or to privately owned companies with no outside institutional equity ownership (non-sponsored deals).

In the upper middle market, private credit begins to overlap with broadly syndicated loans and high yield bonds, leading to a need for private credit managers to “match the terms” common in these markets. These loans do not typically have financial covenants – hence the name, “covenant-lite.” They also do not typically have robust affirmative and negative operating covenant packages. Like the lower middle market, the borrower universe in the upper middle market is made up of sponsored and non-sponsored companies.

Private credit managers often make small equity co-investments alongside the private equity sponsors as a core part of their direct lending strategy. This creates a small, diversified equity co-investment portfolio within the larger credit-focused portfolio to help offset possible credit losses and potentially enhance returns by participating in the equity upside along with the sponsor.

A Symbiotic Relationship with Private Equity

For many RIAs, private credit can help investors add depth to their client’salternatives allocation, especially for those already investing in private equity. RIAs andhigh–net–worthinvestors withprivate equity investment experience are positioned to understand the relative risk-return tradeoffs when compared toprivate credit and how the two asset classes can be complementary in a portfolio.

Private credit, for instance, delivers consistent, cash-pay income throughout the hold period. There’s generally little to no “J-curve” as fees are only charged on invested capital and expenses and management fees are generally covered by current income from inception. This dynamic allows for cash distributions very early in the fund life.

This cash generation and the position of middle market loans in the capital structure reinforce the symbiotic relationship with private equity. Middle market corporate loans are typically first–lien, senior secured (commonly referred to as “top of the balance sheet”) with floating interest rates. In a worst-case scenario, senior secured lenders are the last to incur capital losses. This has historically resulted in low loss rates and an attractive risk-return profile. In the current interest rate environment, a typical private credit vehicle is targeting high single- to low double-digit net IRRs, which should increase over time if interest rates continue to move higher. This predictable current income over the life of a private credit investment, coupled with strong capital preservation, can complement the back-ended, more variable returns associated with private equity.

Additionally, middle market corporate loans are often refinanced or repaid ahead of maturity, with a typical average duration spanning three years or less. This makes private credit a lower–duration investment strategy.

A Lower Risk ‘Alternative’ Asset Class

To drill into an earlier point, there are other factors that play into private credit’s low–risk reputation. Mature direct lending platforms provide proven underwriting.Experienced private credit managers have developed broad transaction–sourcing networks that generate high levels of deal flow. This allows managers to build granular portfolios diversified by geography, industry and underlying private equity sponsorship. Strong transaction origination also allows successful private credit managers to be very selective,typically closing on a small fraction of transactions reviewed in any given year. The key attributes of strong middle market corporate credits includestable, consistent cash flow; attractive loan–to–value ratios (LTV); variable operating–cost structures; significant growth potential; and proven management teams.

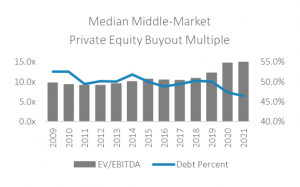

Direct lending in the middle market has also avoided some of the excesses witnessed in other corners of M&A. This is evident in the increasingly attractive LTV dynamics over the last few years. As middle market private equity buyout multiples have soared, the percentage of debt funding these deals has moved in the opposite direction. The median percentage of debt in middle market private equity deals last year stood at just over 46%. This compares favorably to three years earlier when debt comprised approximately 50% of the funding for middle market buyouts, according to PitchBook data.

Direct lending in the middle market has also avoided some of the excesses witnessed in other corners of M&A. This is evident in the increasingly attractive LTV dynamics over the last few years. As middle market private equity buyout multiples have soared, the percentage of debt funding these deals has moved in the opposite direction. The median percentage of debt in middle market private equity deals last year stood at just over 46%. This compares favorably to three years earlier when debt comprised approximately 50% of the funding for middle market buyouts, according to PitchBook data.

Lower LTVs offer a larger cushion that protects against the risk of multiple contraction or declines in financial performance. It’s worth noting that when comparing lower middle market credits against loans in the upper middle market, the LTV dynamics can appear quite similar – however, total leverage multiples can diverge materially. The upper middle market typically sees higher average purchase price multiples fueled in part by higher leverage levels – typically 5x to 7x EBITDA. The lower middle market, in contrast, typically sees leverage between 3x to 5x EBITDA. Lower debt-to-EBITDA ratios can allow a business to de-lever more rapidly while protecting LTV ratios over time in the event of negative operating performance.

Private credit’s long–term history of low default and loss rates, combined with low volatility, demonstrates the relative safety of the asset class. According to CDLI data extending back to September 2004, the average annual loss rate of realized losses is 1.17% – and this includes realized losses as a result of the Great Recession. Focusing in on the Cliffwater Direct Lending Index – Senior (CDLI-S), which tracks managers focused on first lien senior secured loans dating back to September 2010, the average annual loss rate of realized losses is only 0.12%. For this reason, in addition to the departure of traditional banking institutions from the market, many private credit providers have migrated up the balance sheet over time – focusing more and more on first lien senior secured loans.

Private credit’s long–term history of low default and loss rates, combined with low volatility, demonstrates the relative safety of the asset class. According to CDLI data extending back to September 2004, the average annual loss rate of realized losses is 1.17% – and this includes realized losses as a result of the Great Recession. Focusing in on the Cliffwater Direct Lending Index – Senior (CDLI-S), which tracks managers focused on first lien senior secured loans dating back to September 2010, the average annual loss rate of realized losses is only 0.12%. For this reason, in addition to the departure of traditional banking institutions from the market, many private credit providers have migrated up the balance sheet over time – focusing more and more on first lien senior secured loans.

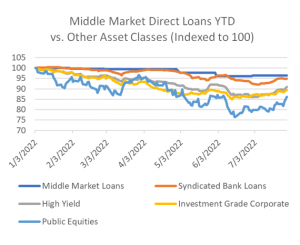

Finally, the lower volatility of middle market direct lending tends to stand out. This is particularly the case during disruptions to the economy, when other fixed income categories and public equities see their prices vacillate or decline. For instance, over the first six months of the year, middle market direct loan prices have held steady, providing investors with a ballast while other asset categories have experienced wide swings (see graphic).

An Effective Inflation Hedge

As of mid-July, consumer prices were up by more than 9% year over year, the largest increase in four decades. To address these rising prices, the Federal Reserve has taken a hawkish stand and increased rates materially, with the Federal Funds target rate increasing from 0.25% at the beginning of the year to 2.50% as of late August. While there is debate as to where inflation will go in the near to medium term, most forecasters expect rates to continue to rise through the remainder of 2022 and well into 2023 as the Federal Reserve continues to push inflation down to target levels near 2%.

Middle market direct loans are typically floating-rate instruments, making private credit a strategy that is well positioned to provide an effective hedge against inflation and rate hikes. Unlike fixed-rate instruments that can lose value and present higher levels of volatility in the current environment, valuations in private credit should remain relatively stable and yields will increase as rates rise.

Conclusion

The question of “Why private credit?” answers itself as investors begin to appreciate the different attributes of the asset class. Direct lending to middle market companies with attractive fundamentals and catalysts for growth makes sense over the long term, especially in periods of instability. Private credit has also demonstrated its ability to deliver stable income and low volatility across multiple economic cycles. Lower middle market strategies provide a way to gain diversification in the asset class, with enhanced protection through lower leverage multiples and strong covenants.

End notes:

Cliffwater Direct Lending Index (Source: Cliffwater LLC)

The Cliffwater Direct Lending Index (CDLI) seeks to measure the unlevered, gross of fee performance of U.S. middle market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.

CDLI-S is comprised primarily of senior and unitranche loans held within BDCs and was created to address the comparative performance of senior middle market loans and the entire universe of middle market loans represented by CDLI.

Index Descriptions

- Middle Market Loans – average bid, middle market ($350mm or less); Source: Leveraged Commentary & Data (LCD); S&P/LSTA Leveraged Loan Index

- Syndicated Bank Loans – S&P/LSTA U.S. Leveraged Loan 100; Source: Bloomberg (SPBDLLB)

- High Yield – Bloomberg US Corporate HY Bond Index; Source: Bloomberg (LF98TRUU)

- Investment Grade Corporate – Bloomberg US Corporate Bond Index – Investment Grade; Source: Bloomberg (LUACTRUU)

- Public Equities – S&P 500 Index; Source: Bloomberg (SPX)